Robust competition in any market is a good thing. It keeps suppliers on their toes, applying constant pressure to build the best possible products with the shortest lead times and most aggressive prices. Customers benefit, and in the context of CAD workstations, that means both end-users and the OEMs that select and bargain for the best hardware components to outfit those systems.

While certainly preferable to a monopoly, a duopoly isn’t necessarily a whole lot better. That goes double when one dominates to the extent that NVIDIA does today over AMD in the market for workstation-caliber GPUs serving professional visual computing markets like CAD. The former has become a virtual monopoly, while the latter has hung on in the marketplace for several years commanding single-digit market share, though each refresh of its Radeon Pro line an opportunity to reset that status quo.

With a price tag suited to the widest breadth of the CAD base, AMD’s new Radeon Pro W6400 is the tool the company’s hoping can kickstart some renewed headway. If AMD can finally find that elusive tailwind, and should an aspiring new suitor joining the field in 2022 gain a meaningful foothold, the CAD community may be seeing a market transition from a de facto monopoly in discrete workstation GPUs to a more competitive three-way rivalry.

The Radeon Pro W6000 family from AMD with the new W6400 GPU. (Image source AMD)

The Radeon Pro W6400: RDNA2 Dives Down the Price Curve

With a sub $300 sales price to fit the budget of virtually any CAD professional, the W6400 targets the highest-volume sweet spot of the professional marketplace. The W6400 is the third Radeon Pro SKU built from AMD’s most recent GPU architecture, RDNA2, covered previously here and here. Following the norm for most new technology rollouts, RDNA2 for workstations arrived first at the upper end of the market, with the ultra-high end Radeon Pro W6800 selling for around $2,250 and the mid-range Radeon Pro W6600 priced around $649. While the W6800’s price limits its appeal to only the upper-most fringe of the market, the W6600 slots into the more accessible mid-range of the market. But as expected, the W6600 did not mark the low point for RDNA2-based Radeon Pro pricing. While the W6600 presented a more accessible RDNA2 class GPU for AEC and product design types to consider, the new sub $300 W6400 pushes the door wide open.

|

Radeon Pro W6800 |

Radeon Pro W6600 |

Radeon Pro W6400 |

|

|

Form Factor (PCIe x16) |

Dual slot |

Single slot |

Single slot |

|

Compute Units (CUs) |

60 |

28 |

12 |

|

Infinity Cache (MB) |

128 |

32 |

16 |

|

Graphics Memory (GDDR6 GB) |

32 |

8 |

4 |

|

Power Requirement |

250 W |

100 W |

40 W |

|

Approximate Pricing |

$2,250 |

$649 |

$300 |

Specifications for Radeon Pro W6800, W6600, and W6400. (Data source: AMD)

With hardware ray-tracing support, all the new RDNA2 Radeon Pro SKUs also let CAD pros dip their toes in GPU-accelerated rendering. That in turn should mean more frequent max-quality visualization in the design cycle for tweaking style, aesthetics, ergonomics, and marketing.

Of course, the W6400’s cut in price also means a cut in raw hardware resources, as detailed above. But particularly for mainstream buyers, remember first that 3D graphics performance does not track linearly with resource metrics, and second, that many workflows and content don’t require all-out performance.

Benchmarking the Radeon Pro W6400

How much does 3D graphics performance drop, moving down the price range of RDNA2 Radeon Pro family? To get a feel, I benchmarked the new W6400 with the most vendor-neutral, CAD-relevant benchmark available, SPECviewperf 2020. Providing context are the SPECviewperf 2020 results from testing of both W6400 siblings, the W6800 and W6600, as well as results on NVIDIA’s closest-priced rival, the Quadro T600.

It’s worth noting that the T600 scores are based on testing I did not perform (sourced from Leadtek.com), but are quite likely to reflect the results my testing would have yielded. Also consider that the T600 is already a year old, and NVIDIA is likely to refresh that tier with an updated offering before the W6400 sees its successor. Finally, the W6600 scores are included for reference rather than as a fair comparison, as its price point makes it an apple to the W6400 and T600 oranges.

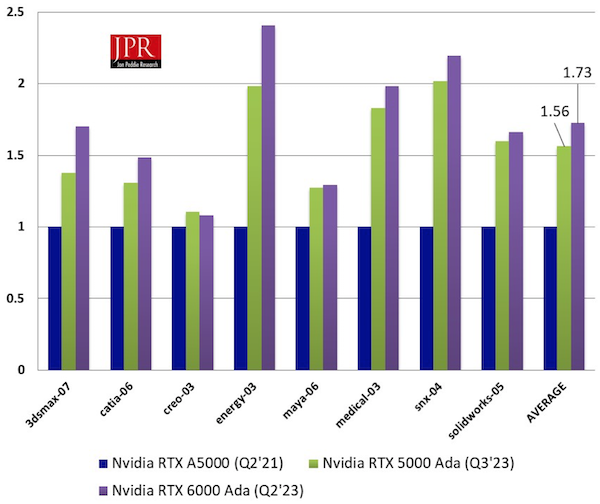

First, let’s take a look at the raw scores for the SPECviewperf 2020 suite. If preferred, consider the scores on the specific viewsets for those applications of most relevance to your workflow. Viewsets from 3dsmax, CATIA, Creo, Siemens NX, and SOLIDWORKS are all included, along with a few representing other professional-class workloads in medical, entertainment, and energy spaces. As expected, the more expensive W6600 dominates with scores on average 112% higher than the T600. The more recent and only modestly more expensive W6400 yields scores more in line with the T600, 16% higher on average.

SPECviewperf 2020 raw scores, normalized to the Quadro T600 (Data source: author and leadtek.com)

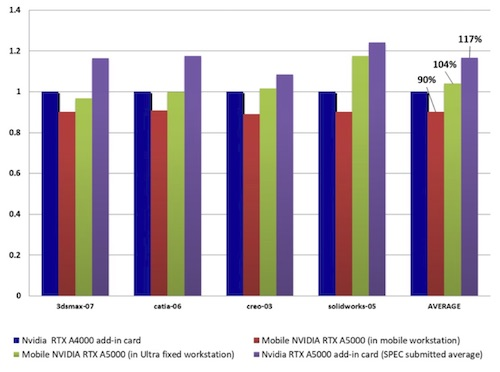

With the T600 currently available at that modestly lower price than the W6400 (both prices sampled online from major retailers on the same day), perhaps the fairest comparison is to make is with price-performance, in this case scores per dollar. Adjusting for price, we see the W6600 lag behind both the W6400 and T600, expected behavior as returns diminish heading up a product line’s price tiers. More relevant, the Radeon Pro W6400 and Quadro T600 are on remarkably (though not unexpectedly) equal footing. The W6400 scores a nudge behind the T600 on average, though the margin is negligible considering the possible error in estimated pricing and the aforementioned third-party T600 testing. The bottom line: the Radeon Pro W6400 roughly matches the Quadro T600 in price-performance for typical 3D CAD graphics processing.

SPECViewperf 2020 scores per dollar, normalized to the Quadro T600. (Data source: author and leadtek.com)

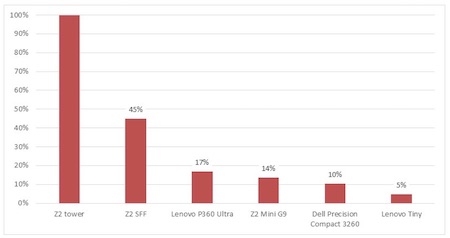

A Potential Non-starter for Some: W6400’s Dual Display Support

While many users can sensibly trade off some performance in favor of the W6400’s attractive price point, they may not be able to compromise on its display support. Specifically, the W6400 does not support a triple-monitor setup, instead limited to two (up to 4K) displays. AMD reasons that the bulk of mainstream users — those most likely to consider the W6400 over a higher priced SKU — are much more likely to rely on one or two displays. That may be true, though that data may be slanted by mobile workstation users, which by default are far more likely relying on only the built-in display. But if you are among those relying on three at the desk today (and feel the pain when stepping back to two or one), the W6400 won’t be an option for you. Furthermore, consider that the rival NVIDIA Quadro T600 can support four, and even AMD’s own Radeon Pro WX 3200, a similarly priced and almost 3-year old SKU that the W6400 should obsolete, could support 3 displays, even at 4K.

The W6400 stands apart with display interfaces limited to 2. (Image source: AMD)

With No More Triage at AMD — and Another Foray by Intel — the Future Should Look a Lot More Competitive

In the market for discrete, dedicated GPUs, we’ve had a duopoly for some time now, with NVIDIA and AMD representing the only practical shops in town. The simple fact that we are down to two is noteworthy in itself, considering how the market for PC-class 3D GPUs started and evolved. Back in the early 90’s, when the industry began recognizing the opportunity to employ the PC as a 3D graphics machine — for things like CAD but more so gaming — vendors looking to cash in as a provider of GPUs (initially called “graphics accelerators,” “graphics controllers,” or “GUI accelerators” back then) numbered not in the single digits but in the 20s. Once the dust settled after that graphics chip gold rush, only NVIDIA and ATI (acquired in 2006 by AMD) were eventually left standing.

As NVIDIA’s lone challenger, AMD has managed to keep up the pressure, albeit without a whole lot of reward, at least in the context of workstation-caliber discrete GPUs. NVIDIA commands the vast majority of the market, and despite solid products, AMD has not been able to muster any significant momentum to take back share in several years. With RDNA2, AMD appears to have held serve its competition with NVIDIA, with this new most impactful member of the Radeon Pro family, the W6400, offering essentially equivalent price-performance to NVIDIA’s comparable product at a similar price point. But while that does help both OEMs and end-users alike to keep NVIDIA honest with viable alternatives to buy, simply matching NVIDIA won’t likely be enough to make any significant dent in NVIDIA’s dominant share.

Still, there’s also no reason to think AMD will forever be consigned to the role of NVIDIA’s little brother when it comes to professional graphics. Remember AMD played that very role to Intel for years in its other core market, CPUs, essentially picking up Intel’s leftovers in the market —— typically lower performance, lower margin parts — but all that’s since changed. As we’ve covered here several times in the past few years, AMD has not only matched long-time processor rival Intel on the CPU side, in significant respects (e.g. core counts) it’s pushed past.

That pronounced rebound in CPUs has put AMD in a very different place relative to NVIDIA that it has been in the past. Prior to its recent resurgence, I often sensed AMD product development was too often forced into triage, trying to fight too many battles on two fronts — Intel in CPUs and NVIDIA in GPUs — and with more limited resources than either rival. The company had to match up across the board, but spread so thin it had to prioritize which battles to fight and how much wood to put behind its arrows. But thanks to the rebound in the market for high performance CPUs, which has translated into a far more robust financial position, AMD is in a better place than ever to deploy the resources to start reeling NVIDIA back in.

All that said, there’s a wild card soon in play in this battle for discrete workstation GPUs, and that’s Intel. I’ve made a point to use the “discrete” descriptor throughout this discussion of competing AMD and NVIDIA GPUs. Because in reality, neither is the highest volume supplier of all GPUs serving PC-related markets. Rather, with the rise of CPU-integrated graphics acceleration, the leader is Intel. The two GPU segments don’t actually compete that much directly, in the sense a discrete and an integrated GPU serve two clearly delineated segments. Those looking for better or best performance choose a discrete, and those looking for the best price with good-enough graphics chose the CPU-integrated option.

But the landscape for discrete GPUs looks to expand this year, as Intel makes its anticipated entrance to the arena. The company plans to roll out a broad family of with its Arc line of discrete GPUs, including members targeting both high-performance consumer (i.e. gaming) and professional applications. A potentially formidable competitor, Intel should turn the discrete GPU duo to a trio.

Now, it’s worth injecting a bit of history here to temper any notions that Intel will come in and simply take over the market for discrete GPUs. While as intimidating a rival as any, Intel actually has a poor track record in this space. Arc won’t mark the first time that Intel’s tried to crack the discrete GPU market, in fact not even its second. The company has made several attempts over the past three decades, most of which were cancelled before even yielding a product to market. That aside, to dismiss Arc to the same fate would be a mistake as well, as the company has learned valuable lessons and put in places resources to make its chances at some degree of success far more likely this time around.

An NVIDIA that never seems to stumble, an AMD with resources that should allow it to finally go all-in, and a new entrant from Intel with all the tools it should need to be successful: the market that NVIDIA has essentially had to itself is looking to get a whole lot more competitive in 2022. CAD users should see a wider range of GPU options than ever to serve its 3D visualization demands.

Alex Herrera

With more than 30 years of engineering, marketing, and management experience in the semiconductor industry, Alex Herrera is a consultant focusing on high-performance graphics and workstations. Author of frequent articles covering both the business and technology of graphics, he is also responsible for the Workstation Report series, published by Jon Peddie Research.

View All Articles

Share This Post